In our post Starting the Year Right: Meeting Your Annual Compliance Requirements, we listed the books of accounts as one of the requirements of the Bureau of Internal Revenue (BIR) for businesses. These books, which you have to register with the BIR, list all the transactions of your business. Registration of these is done when you first register your business with the BIR, and every year after that.

This article covers the essential things you need to know about the books of accounts. Let’s start with their various types.

Types of Books of Accounts That May be Registered

You have three choices when it comes to the format of your books of accounts, each of which has its own advantages and disadvantages. These books are:

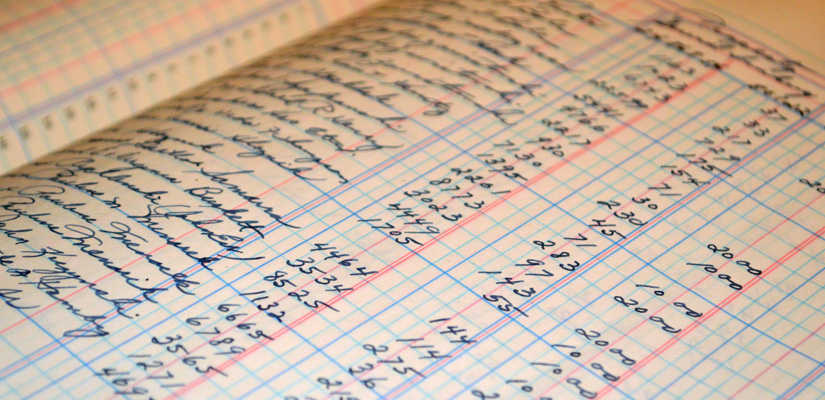

Manual Books: The most basic among the three are manual books of account, which are also known as journals, ledgers, or columnar books. You enter transactions manually into the book, making it ideal for smaller ventures, which need to record only few transactions. These are also more accessible and affordable since you can purchase them at stores where office supplies are sold. Another advantage of manual books is that these require less maintenance as you need to register or submit these to the BIR only when you are required to do so.

Loose-leaf Books: Loose-leaf books strike the balance between the ease of using manual books and the efficiency of computerized books. You can use any spreadsheet account such as Microsoft Excel or Google Sheets to record your transactions, which you should then print and bind. This option is perfect for recording large volumes of transactions without the cost or complexity of using a specialized accounting software. Unlike manual, books, however, you are required to register loose-leaf books on or before January 15 of every year.

Computerized Books: For even larger transactions and more complex computations, you can use an accounting software to do the job for you. This is more suited to larger enterprises and even multi-site businesses as there are software that allow you to collate data from different sites or branches. The downside to this is the steep cost of purchasing and maintaining the software. Also note that when submitting computerized books to the BIR, these must be in a CD-R, DVD-R, or other optical media format. The deadline for submitting this is on or before January 30 of every year.

Types of Books Businesses Should Keep

While the list above shows the formats in which you can register your books, you need several of your chosen format depending on your type of business. These are the following:

While the list above shows the formats in which you can register your books, you need several of your chosen format depending on your type of business. These are the following:

- General Journal – Better known as the book of original entry, this contains your business transactions sorted by date.

- General Ledger – This is the so-called book of final entry because it summarizes all the transactions of the account and computes the ending balance.

- Cash Receipt Journal – As the name would suggest, this lists cash received by the business, specifically sales and collections.

- Cash Disbursement Journal – Cash that is spent by the business for payment of services, products, and other expenses is listed here.

- Sales Journal – This lists sales on credit, or cash received from customers.

- Purchase Journal – This lists purchases on credit, or cash that must be paid to suppliers.

Of these books, only the first four are required if you are a services provider. Meanwhile, all books are required if you sell goods or properties.

How Long You Should Keep Your Books

According to the BIR’s Revenue Regulations No. 17-2013, businesses are required to preserve all their books of accounts and accounting records for 10 years from the day after the deadline of filing a tax return, or from the date of the filing of the return for the taxable year when the last entry has been made on the books in case of books that were filed after the deadline.

In addition, you are required to store your books and other supporting records and documents in your place of business. These may then be subject to audit by the BIR for a variety of reasons, including regular audits.

When You Lose Your Books

In the event that you lose one or more of your books of accounts, you will have to submit a notarized affidavit of loss to the Bureau. You may then be subject to penalties depending on the cause of the loss of your books.

Maintaining and storing your books are without a doubt time-consuming yet essential requirements in ensuring that you pay the correct taxes. This is where a tax consultant, a professional tax services firm, or an account may be able to help you. Their knowledge and expertise on tax-related matters will help you cut through the complexity and the laborious process of keeping your books. For more information on how a dedicated accountant can assist you, contact us today.

Disclaimer: Information contained in this article may become outdated and is therefore meant as general guidance only. It is not intended as professional accounting or tax advice.